How AI-Driven Research is Transforming Data-Intensive Consulting and Finance

In today’s consulting and financial services landscape, professionals face mounting pressure to deliver insights faster, with greater accuracy, and at lower costs. Yet, despite technological advancements, a surprising portion of research, risk assessment, due diligence, and compliance verification remains largely manual and time-consuming.

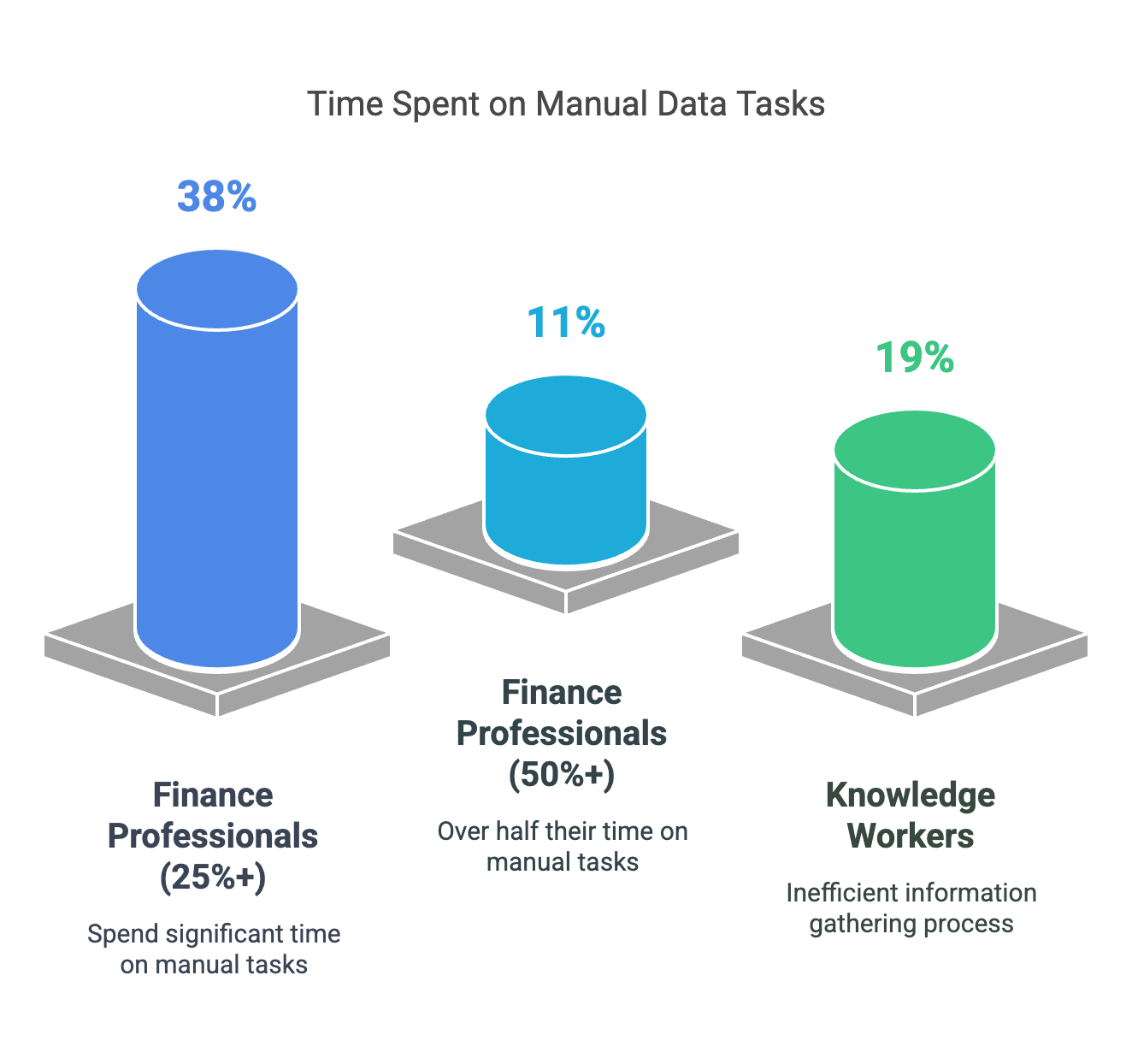

A survey by Airbase revealed that 38% of finance professionals spend over 25% of their time on manual data tasks, with 11% dedicating over half of their time to such activities. Similarly, a McKinsey & Company report found that knowledge workers spend up to 19% of their workweek searching for and gathering information—a staggering inefficiency in high-value industries.

Enter Cognitive Data Process Automation (CDPA)—a transformative approach leveraging agentic AI workflows to automate data collection, normalization, analysis, and reporting at scale. By eliminating ineffective approaches, CDPA allows firms to deliver insights faster, reduce operational costs, and unlock new revenue models.

The Bottleneck in Research-Heavy Workflows

The traditional research and due diligence process is inherently inefficient:

Manual Data Gathering: Professionals sift through unstructured data like PDFs, spreadsheets, regulatory reports, and fragmented databases.

Inconsistent Validation: Data sources vary in structure and reliability, making validation labor-intensive.

Static, Non-Integrated Data: Insights become obsolete as soon as they are collected, requiring continuous manual updates.

These inefficiencies slow down decision-making and increase operational costs, particularly for firms handling high data volumes.

For example, a global real estate management firm seeking to track the carbon footprint of thousands of consumable products faced a bottleneck in manual data research. Historically, this process involved:

Weeks of manual effort to compile sustainability impact reports.

Annual updates that quickly became outdated.

High research costs due to the labor-intensive nature of data verification.

By integrating CDPA-driven workflows, the firm automated data retrieval, normalized supplier-provided data, and dynamically updated sustainability scores in real-time. The result:

✔ High-quality ESG data retrieval in seconds

✔ Continuous updates replacing static, outdated reports

✔ 80% cost savings on sustainability research

✔ Zero manual research effort required

Request demo of this case.

Where Traditional AI Tools Fall Short

Despite advancements in AI, many current research tools fail to fully automate data-heavy workflows.

Below is a comparison of existing solutions vs. CDPA-driven research automation:

| Industry | Traditional AI-Enabled Solution | Limitations | Does it Enable Fully Agentic Workflows |

|---|---|---|---|

| Consulting (Market intelligence, risk assessment) | AlphaSense, CB Insights, Quid | Search-based insights, no workflow automation | ❌ No |

| Financial Services (Due diligence, compliance, investment research) | Kensho, FactSet AI, BloombergGPT | Limited contextual analysis, static data | ❌ No |

| Supply Chain (Vendor risk, procurement research) | Tealbook, Prewave, Craft AI | Risk identification only, lacks full automation | ❌ No |

| ESG & Compliance (Regulatory tracking, sustainability reporting) | Datamaran, RepRisk, GaiaLens | Static ESG scoring, lacks real-time adaptability | ❌ No |

| Legal & Policy Research (Case law, regulatory monitoring) | Casetext, Bloomberg Law AI, ROSS | NLP-based search, no automated validation | ❌ No |

While these tools provide some level of AI-powered search and data structuring, they do not integrate real-time, dynamic automation—a gap that CDPA and agentic AI workflows are now filling.

Agentic AI Workflows: The Future of High-Volume Research & Due Diligence

CDPA is particularly impactful in fields where data-heavy analysis, risk assessment, and compliance workflows define success. Here are some additional high-impact use cases that are already being automated today:

1. Automating Data Room Due Diligence in Financial Transactions

Investment firms, M&A advisors, and private equity firms must analyze hundreds of due diligence reports, comparing contracts, historical financials, and risk disclosures. A CDPA-driven workflow:

✔ Extracts and normalizes structured and unstructured data from data rooms

✔ Cross-references against industry benchmarks for deeper insights

✔ Detects anomalies and inconsistencies in disclosures, reducing compliance risk

2. Enabling Dynamic Research & Report Generation for Risk Analysis

Whether in financial risk assessment, geopolitical analysis, or ESG compliance, reports that used to take weeks can now be generated dynamically:

✔ Pulling real-time intelligence across multiple data sources

✔ Structuring findings into automated reports

✔ Allowing for continuous monitoring rather than one-off research projects

3. Automating Sprawling Excel-Based Research Processes

Many financial analysts and consultants still rely on Excel-based workflows, with sprawling datasets requiring constant manual reconciliation, formula updates, and data validation. Agentic AI enables:

✔ Querying across thousands of Excel files dynamically

✔ Applying new financial models without needing manual restructuring

✔ Instantly detecting errors, duplicates, or missing field

4. AI-Powered Procurement Intelligence for Supply Chain Analysis

Procurement teams and supply chain analysts struggle with fragmented vendor data, spending months comparing supplier reports, cost structures, and risk factors. A CDPA-driven workflow:

✔ Aggregates procurement intelligence from various sources

✔ Automatically normalizes and enriches supplier datasets

✔ Allows rapid vendor risk and cost-benefit analysis

CDPA in Action: Transforming Consulting & Financial Services

Leading consulting firms and financial institutions are already reaping the benefits of agentic AI workflows, shifting from billable hours to value-based services. By automating high-volume research and analysis, CDPA enables firms to:

✔ Deliver insights 5–10+x faster than traditional methods

✔ Reduce research costs by 50% or more

✔ Move from manual, project-based engagements to continuous value delivery

Why Now? The Urgency of AI-Driven Transformation

With AI advancing at an unprecedented pace, organizations that fail to adopt automation-driven knowledge work risk falling behind competitors who can deliver insights in real time at a fraction of the cost.

🔹 McKinsey estimates AI-driven automation will add $13 trillion to global GDP by 2030.

🔹 Forrester predicts that firms deploying AI automation will see operational cost reductions of 30% by 2025.

🔹 Accenture reports that companies investing in AI workflows achieve revenue growth 2.5x faster than their competitors.

By adopting CDPA and agentic AI workflows, firms can scale their expertise, unlock new revenue models, and future-proof their operations in an AI-first world.

Next Steps: Embracing the Future of AI-Driven Research

Transformica AI is working with forward-thinking firms to redefine how consulting, financial services, and compliance teams operate—turning knowledge-heavy workflows into automated, AI-powered decision engines.

Interested in learning how AI-driven research automation can transform your firm? Explore Cognitive Data Process Automation (CDPA) here: